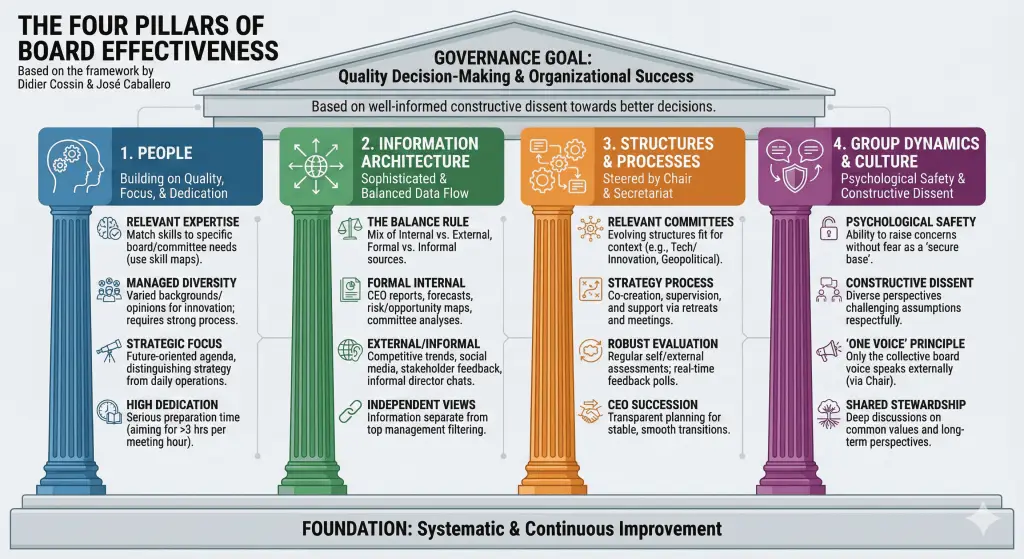

Based on the framework by Didier Cossin & José Caballero

In the bustling business hubs of Nairobi, from the high-rises of Upper Hill to the industrial hum of Industrial Area, the definition of success is shifting. Over the last decade, we have seen massive changes in East African politics, technology (think M-Pesa and the Silicon Savannah), and society.

Whether you are running a family-owned legacy business, a rapidly scaling Kenyan SME, or sitting on the board of an NSE-listed giant, one truth remains: Governance is the single biggest predictor of success or failure.

Governance isn’t just about compliance or ticking boxes for the Capital Markets Authority (CMA). It is about the quality of decision-making.

Based on two decades of clinical work, Professors Didier Cossin and José Caballero have identified The Four Pillars of Board Effectiveness. Here is how Kenyan leaders can apply this framework to future-proof their organizations.

The 4-Pillar Framework

Effective boards don’t happen by accident. They are built on a dialectic process: well-informed, constructive dissent that leads to better decisions.

Pillar 1: People – Quality, Focus, and Dedication

The foundation of any board is who is in the room. In Kenya, where boards are often a mix of family members, political appointees, and industry captains, this pillar is critical.

- The Skill Map: High-profile names don’t always equal high performance. Does your risk committee actually understand the complexities of modern fintech or global supply chains?

- Lesson: Avoid the “trophy director.” Use a skill map (matrix) to ensure every member adds specific value.

- Diversity: This goes beyond gender. It includes diversity of age, background, and opinion. A board of “Yes Men” is a liability. You need members who understand digital transformation alongside those who understand traditional Kenyan market dynamics.

- Dedication: Being a director is not a retirement hobby. Effective directors spend over 10 hours preparing for every hour of meeting time.

- Kenyan Context: With many directors sitting on multiple boards (over-boarding), ensure your members have the actual bandwidth to focus on your company.

Key Question: Does your board have the right mix of skills to navigate the next 5 years, or are you relying on the relationships of the last 10?

Pillar 2: Information Architecture – Beyond the CEO’s Report

Many boards suffer from information asymmetry—they only know what the CEO tells them.

- The Balance Rule: Directors need a mix of internal data (financials) and external data (market trends, social media sentiment).

- Formal vs. Informal: Great boards don’t just read reports. They have informal channels. For example, does the Chair have a constructive relationship with union reps or key stakeholders?

- Design Matters: Information should be designed by the board, not just for the board.

Key Question: Do you have independent information sources, or are you “flying blind” based solely on management reports?

Pillar 3: Structures and Processes – The Engine Room

Good intentions need good engines. This pillar covers how the board actually operates.

- Committees that Work: Do you have a Technology or Innovation Committee? In a market as digitized as Kenya, an Audit Committee alone might not suffice.

- Strategy as a Process: Strategy isn’t a one-day offsite in Naivasha. It is a continuous process of co-creation, supervision, and support between the board and management.

- Succession Planning: The collapse of major firms often traces back to poor succession. Whether for the CEO or board members, the transition must be transparent and planned, not a sudden “horse race” caused by a crisis.

Key Question: Are your board committees designed for your current strategic challenges, or are they just a legacy structure?

Pillar 4: Group Dynamics & Culture – The “Secret Sauce”

This is often the hardest pillar to master in the Kenyan context, where cultural respect for hierarchy can sometimes stifle necessary debate.

- Psychological Safety: Can a junior board member challenge the Chair? If not, you are at risk of “Groupthink.” The board must be a secure base where dissent is encouraged, not punished.

- The “One Voice” Principle: Inside the boardroom, debate should be fierce. Outside the boardroom, the board speaks with one voice (usually through the Chair). Leaks and conflicting public statements destroy trust.

- Constructive Dissent: You want “rivalry” in ideas, not in personalities. A culture of mutual respect allows for hard questions without hard feelings.

Key Question: Is your boardroom a place of “polite silence” or “constructive friction”?

| Pillar | Assessment Question |

| People | “How much time did I spend preparing for this meeting? Was it enough?” |

| Information | “Do I have data that is independent of top management?” |

| Process | “Is our succession plan robust enough to survive a crisis tomorrow?” |

| Culture | “Do I feel safe challenging the majority opinion in this room?” |